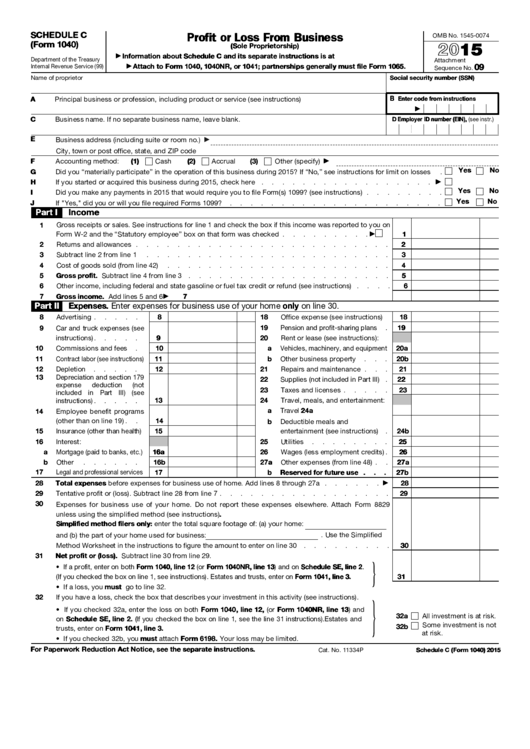

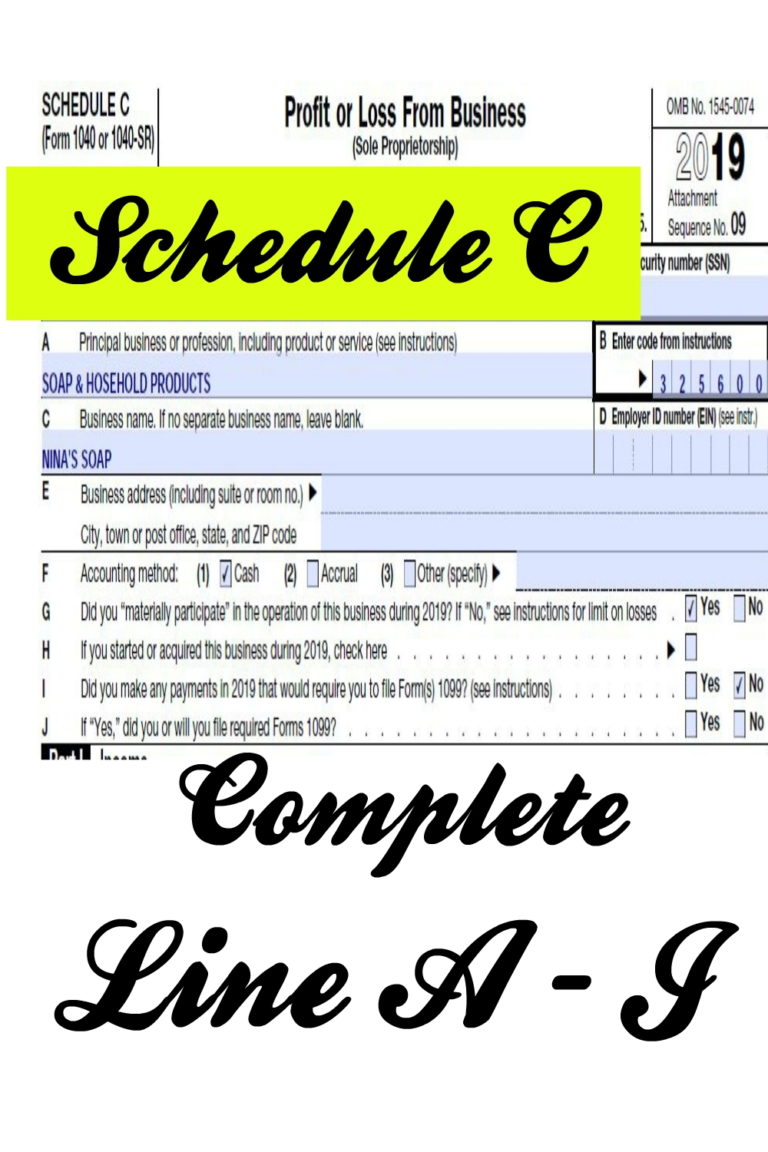

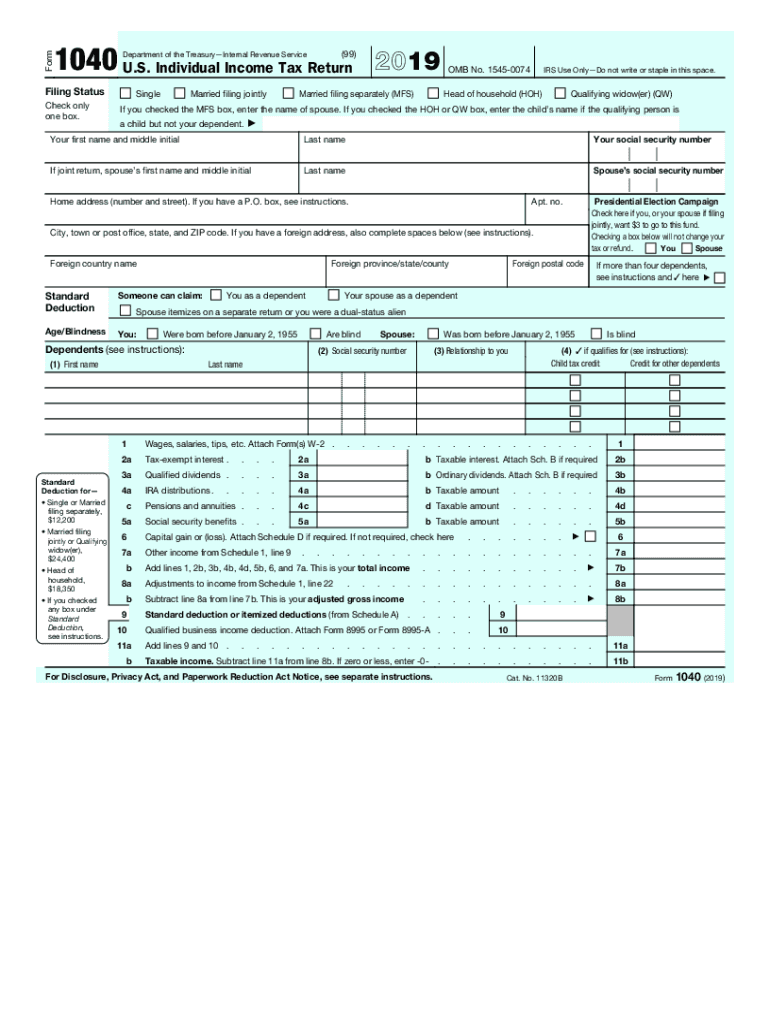

Most of this information should be pretty self explanatory, but there are a few spots that occasionally trip people up: Give Them the Basic Info About Your Businessīefore we get into the numbers, you have to let the IRS know who you are and what your business is. Now, let’s dig into exactly what you’re reporting to the IRS on Schedule C. If you’re using any other type of business structure-like an LLC or partnership-you may need different forms to file your taxes. The Schedule C is meant for Sole Proprietors who have made $400 or more in gross income from their business that year. A change worksheet that records revisions to the spreadsheetĢ.When you’re starting a new business, everything is already overwhelming enough-forget having to fill out new and unfamiliar forms come tax time!Īnd the Schedule C can look like a doozy, but I promise, it’s not that difficult (especially if you’ve been staying on top of your accounting throughout the year).įirst, let’s quickly make sure you’re filling out the correct form.SSA-1099 input form to record Social Security benefits.1099-R retirement input forms for up to nine payers each for a taxpayer and their spouse.1099-DIV dividends and distributions for up to ten payers.1099-INT interest income input forms for up to ten payers.W-2 input forms that maintain up to four employers and their spouse.

Form 8949: Sales and Dispositions of Capital Assets.Form 8889: Health Savings Accounts (HSAs).Form 8283: Noncash Charitable Contributions.Form 6251: Alternative Minimum Tax – Individuals.Form 2441: Child and Dependent Care Expenses.Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and Trusts.Schedule F: Profit or Loss from Farming.Schedule E: Supplemental Income and Loss.Schedule D: Capital Gains and Losses (along with its worksheet).Schedule C: Profit or Loss from Business.Schedule B: Interest and Ordinary Dividends.Microsoft Excel spreadsheet for US Federal Income Tax Form 1040įree Federal Income Tax Form 1040 (Excel Spreadsheed)

0 kommentar(er)

0 kommentar(er)